Personal Loan in UAE

Applying for Personal Loan in UAE may drop you confused about choosing the right Bank that may provide you the best deal as per your current requirements. Locals and Expats working in UAE, sometimes find it difficult to spare time in gathering all the information regarding credit facilities available in the market and end up selecting whatever comes upfront towards them. This may result in you paying more than you need to.

The question is why pay more? Compare all banks across UAE and choose the best that suits your need.

We, at UAE Cash Loans, provide you the platform to compare all banks across UAE at your fingertips. We enable our visitors to apply for a Personal Loan from the comfort of their home or office. Just fill in few details and receive quotations from all the major banks in UAE within 60 Minutes! Comparing to UAE Cash Loans save your time and a lot of money.

Apply for a Personal Loan with UAE Cash Loans to fulfill all your financial emergencies or any personal expense like -wedding, medical emergencies, renovating a home, or even for planning a vacation and save your time and money.

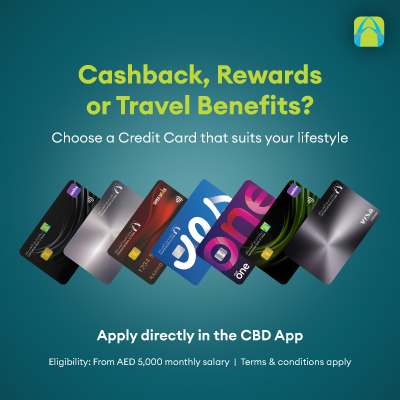

Credit Card in UAE

A credit card is a plastic card with a magnetic stripe that holds a machine-readable code issued by a bank allowing the cardholder to purchase goods or services on credit. The card issuer (usually a bank) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

It is very important to compare Credit Cards in UAE before applying for one. Always compare credit cards on the basis of your spending needs as each credit card is designed with a specific set of benefits like shopping benefits, travel benefits, lifestyle benefits and a lot more. Along with that always keep a check on the fees and charges tagged along with the Credit Card like Interest Rates, Annual Fees, and Other charges.

Top Loans & Credit Cards Providers in UAE

Compare All Banks Across UAE for Personal Loans

Applying with UAE Cash Loans gives you an opportunity to receive instant calls from all major banks in UAE. This will help you to compare all banks across UAE with their eligibility criteria, interest rates, and a lot more. Comparing helps you to make an informed decision while applying for a personal loan in Dubai. Interest rates play a vital role while applying for a personal loan in Dubai. Lower the interest rate, it’s easier to repay. Compare salary transfer loans, non-salary transfer loans, and buyout loans by applying here at Uae Cash Loans.

Key Features for Personal Loan in UAE

Both Salary Transfer and Non-Salary Transfer Loan available

Minimum monthly Income: AED 5,000

Maximum loan amount: AED 1000000

Disclosure Policy:

“UAE Cash Loans” is a Loan Comparison and lead-generating portal that connects consumers with third-party lenders. We do not charge any fee from the applicants. However, we may receive commissions from the banks or agents we refer you to.

The minimum Annual Percentage Rate (APR) is 2.79%, and the maximum Annual Percentage Rate (APR) is 24.99% as per eligibility.

The minimum loan repayment tenor is 6 months and the maximum is 48 months.

Representative Illustration:

For example, a loan amount of AED 100,000 availed for 12 months with an interest rate of 5.10% per annum can be repaid as a total of AED 102,720.

Processing Fee: 1% of Loan amount with min. AED 500 and up to a max. of AED 2,500.

Customer Testimonials

Michaek Kavanagh

Good Website

Ridhesh Koovaparambil Rajan

Good.

Elmotasim Yousif Mohamed

With all respect I heard about your company from a banker friend. Good Website.

Alfredo M Banaag Jr

This website helped me to get my loan approved very quickly. Thanks. Good Luck.

Naisam Nazer

The process was so easy. I applied here and received calls from Banks instantly. Got the money in 7 days.

Dayanand S.

Simple to apply here. Overall excellent, very fast and convenient. Would recommend to anyone and everyone.

Wilson Depalac

Applied at uaecashloans.com and immediately got call from 6-7 banks. Easy to compare loans. I got from FAB. Thanks.

Muhammad Tariq

Great job Uae Cash Loans. Received calls but due to my credit history, did not find any options. Anyways thanks.

Pradeep Veny

Got call from Deem Finance, maybe because my company is not listed anywhere. Deem interest little high. Still looking.

Sophia Dcruz

I applied at uae cash loans and received 7-8 calls. only one call from each back, that’s really good. No unnecessary calls. Great experience.

Frequently Asked Questions

What does UAE Cash Loans do?

We try to help people seeking credit facilities like Personal Loans and Credit Cards in UAE through our online portal. Just fill in your requirements and we will connect you with UAE’s top banks.

How much is the minimum salary required to apply for a Personal Loan in UAE?

The minimum Salary to apply for a Personal Loan in UAE is AED 5,000.

I am new to UAE, can I apply for a loan ?

To avail of any financial credit services in UAE, you must complete at least 6 months in the organization or should be a confirmed employee.

What are top-up loans?

Top-up loans are types of revolving loans that can be availed in addition to the current loan. Once the borrower has made a specified number of installment payments, the borrower can apply for a top-up loan. There are certain other criteria also to be eligible for a top-up loan.

What is payment deferment?

Deferred payment is the delay or postpones of monthly installment payments offered by Banks and Financial Institutions in UAE. The borrower must maintain regular payments to take advantage of these benefits.

What is an early settlement fee?

Early settlement is where you settle your debts before you are legally obligated to do so. Many banks and lenders in UAE impose an early settlement fee for paying off loans early.